Homeownership is an important defense against gentrification, and is often a way for families to build wealth and equity. Owning the home where you usually live offers a much greater degree of stability than renting. June is National Homeownership Month, and we’d like to highlight that for many families in Louisiana, this stability is out of reach due to inequality in mortgage lending.

There is a 30% gap between Black and white homeownership in the United States. As of the 1970 census, 42% of Black families in the US owned homes. In 2020, 41% of Black families own their homes, which means that more than 50 years after the Fair Housing Act, owning your home has become less accessible for Black families. The gap between Black and white homeownership rates is a major contributing factor to the wealth disparity between Black and white families—for every dollar held by the average white family in the US, the average Black family has 13 cents.

In 2020, Hammond, LA had the largest disparity in the country between housing loan denial rates for white and Black applicants. Only 1.5% of Black prospective borrowers were able to purchase a mortgage in Hammond, when 12.5% of white prospective borrowers got the loans they were seeking.

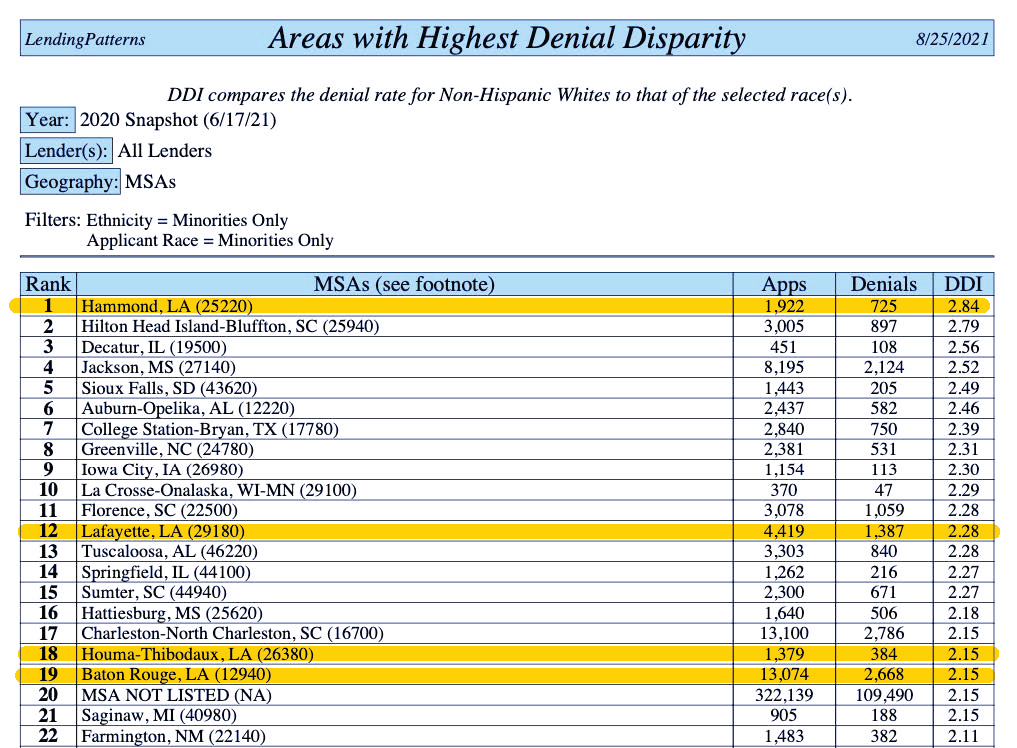

Troublingly, this is a phenomenon all over the state—4 Louisiana Metropolitan Statistical Areas (MSAs) are in the top 20 for racial disparities in lending: Hammond, Lafayette, Houma-Thibodaux, and Baton Rouge. The list shows areas where Black borrowers were denied mortgage loans at a far higher rate than white borrowers. This reflects a nationwide practice: on average, 18.1% of Black prospective homebuyers are denied loans, vs. 6.9% of non-Latinx white borrowers.

In 2020, across the country the number of Black and Latinx borrowers purchasing homes increased, as did their proportion among buyers. Even so, both groups consistently saw higher median interest rates than white or Asian borrowers as well as higher total loan costs despite buying houses that were on average less expensive.

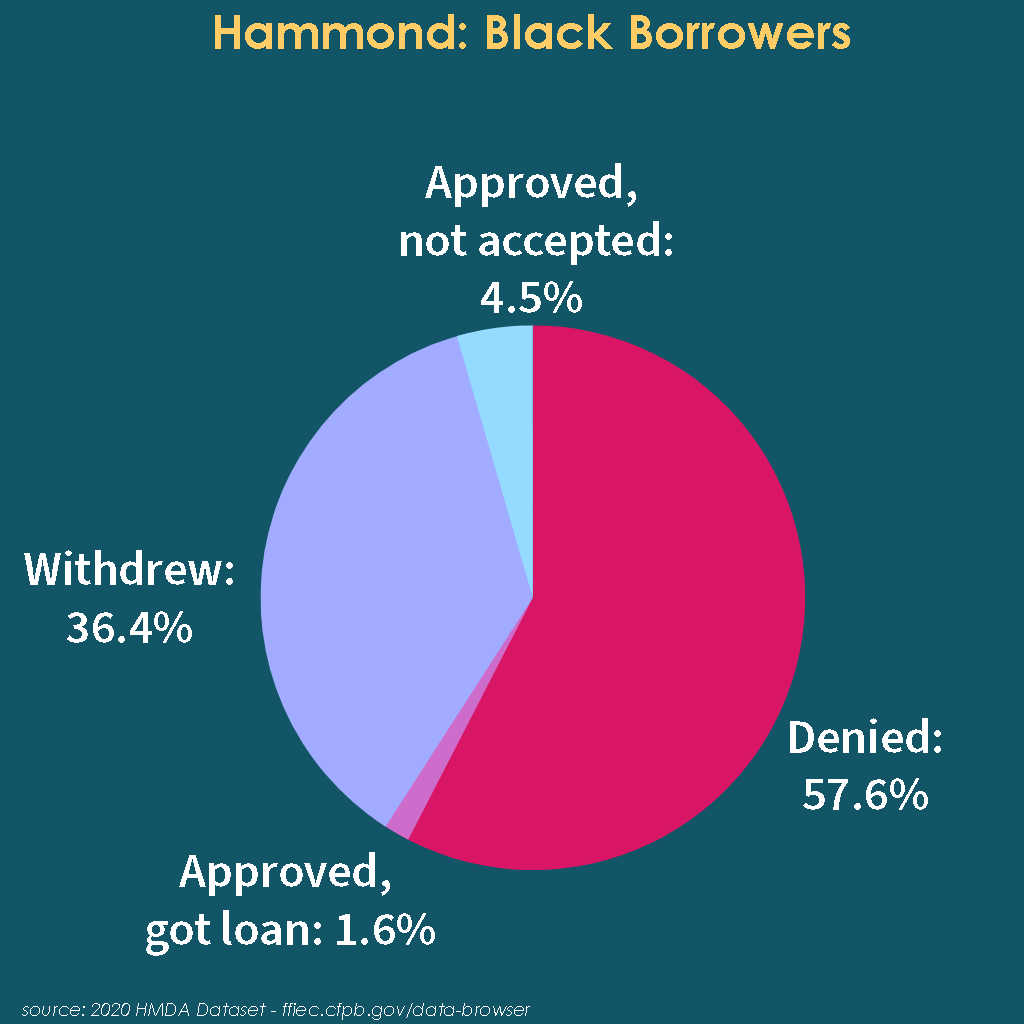

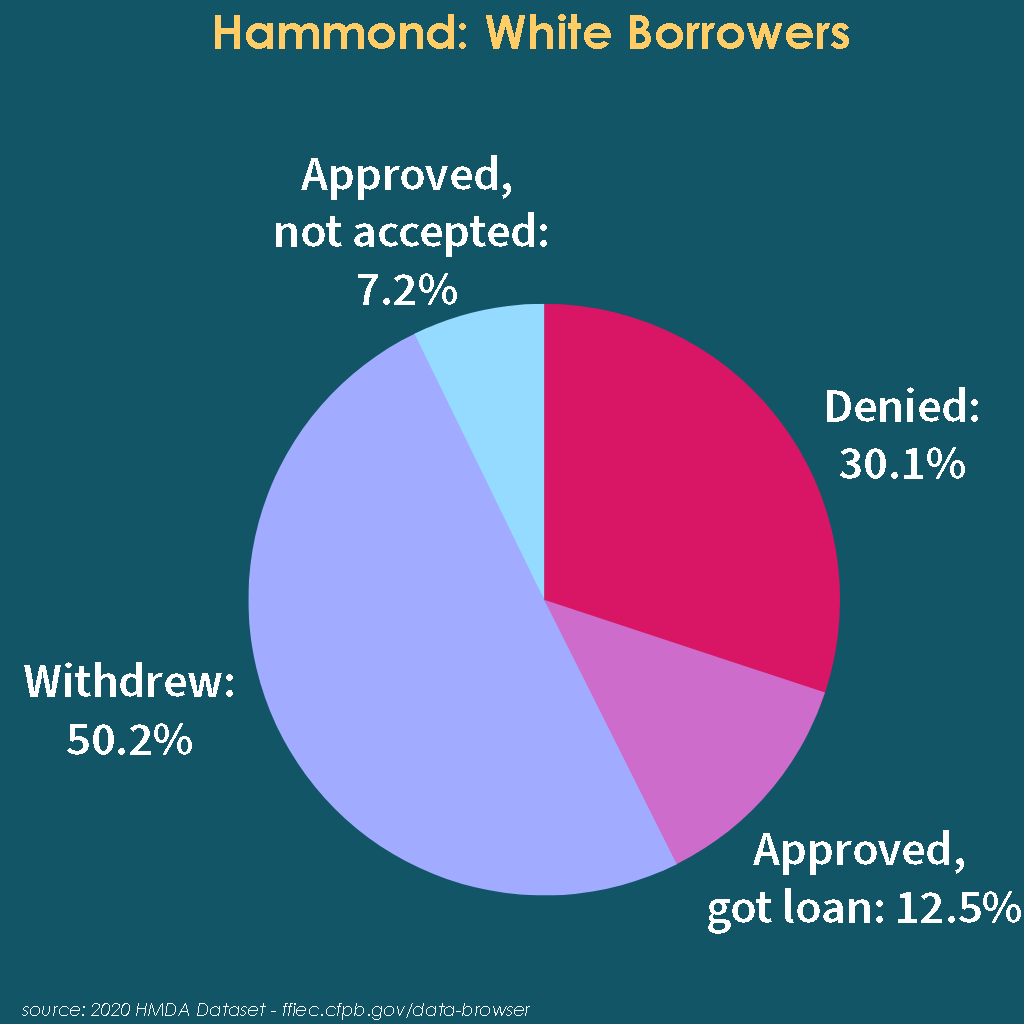

Here is the data for Hammond in 2020:

As you can see, there is a very unequal proportion of successful loan purchases, reflecting a disinvestment in Black homeownership by lenders. Lenders invested $54,650,000 more in loans to white borrowers in 2020, despite Hammond being about 45% Black and 43% white. An equal investment in both communities would see many more Black borrowers able to purchase loans.

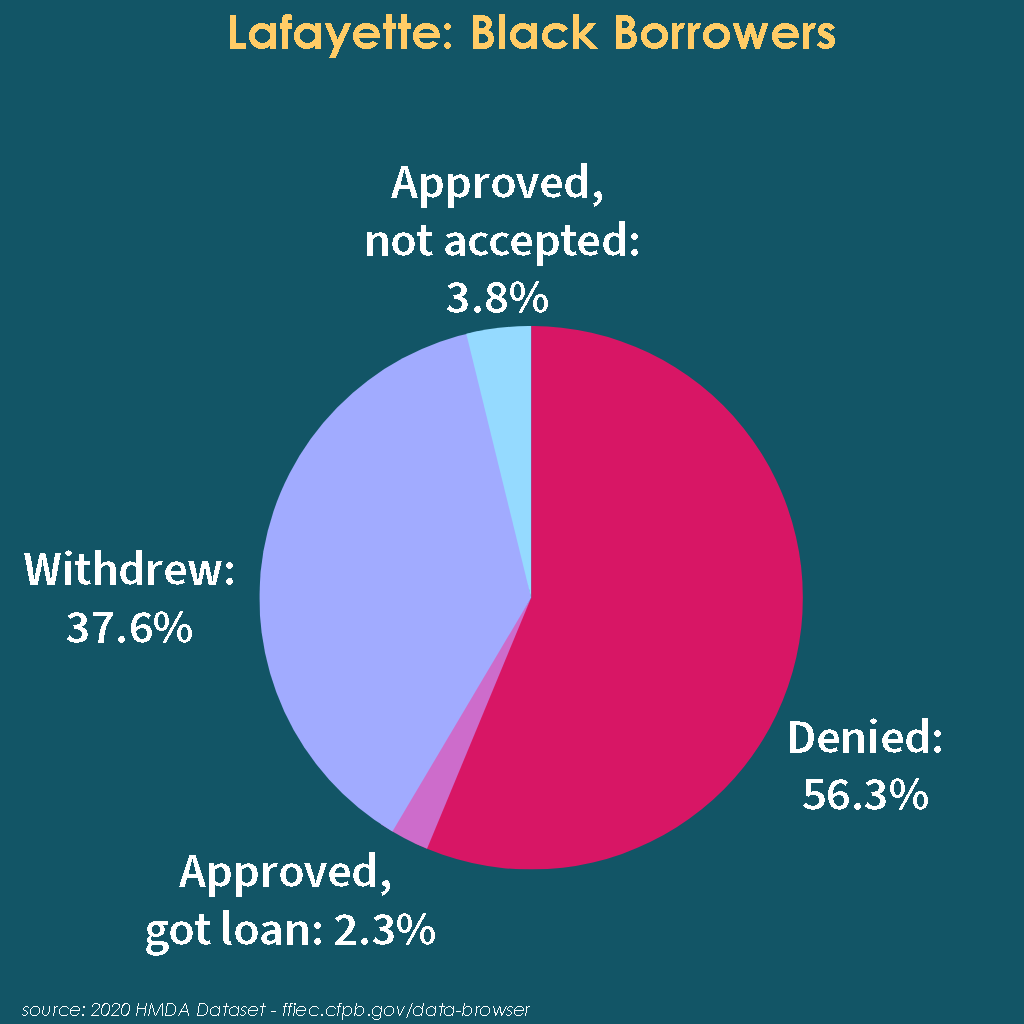

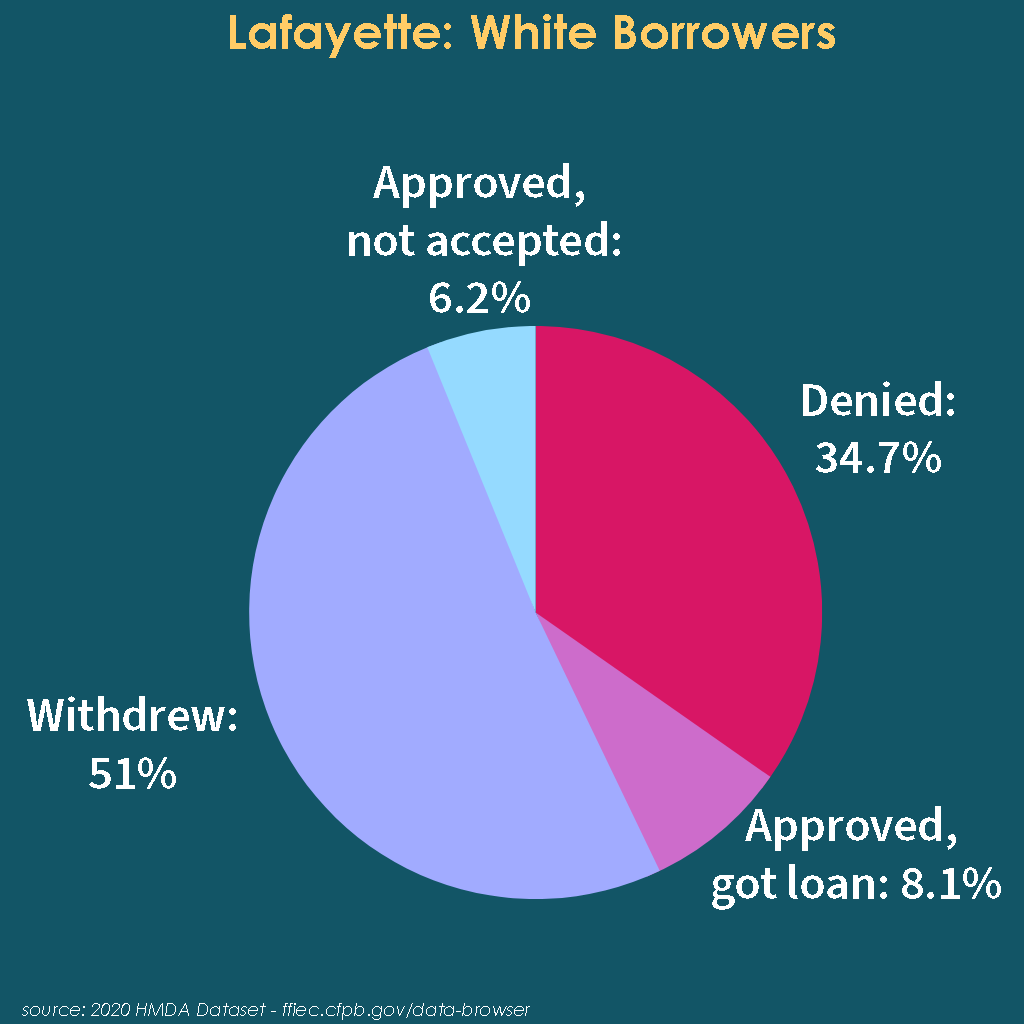

Here is the data for Lafayette in 2020:

While a higher proportion of Black borrowers were able to secure loans in Lafayette, this still represents an underinvestment in Black homeownership—especially since the 2.3% here represents only about 45 borrowers total.

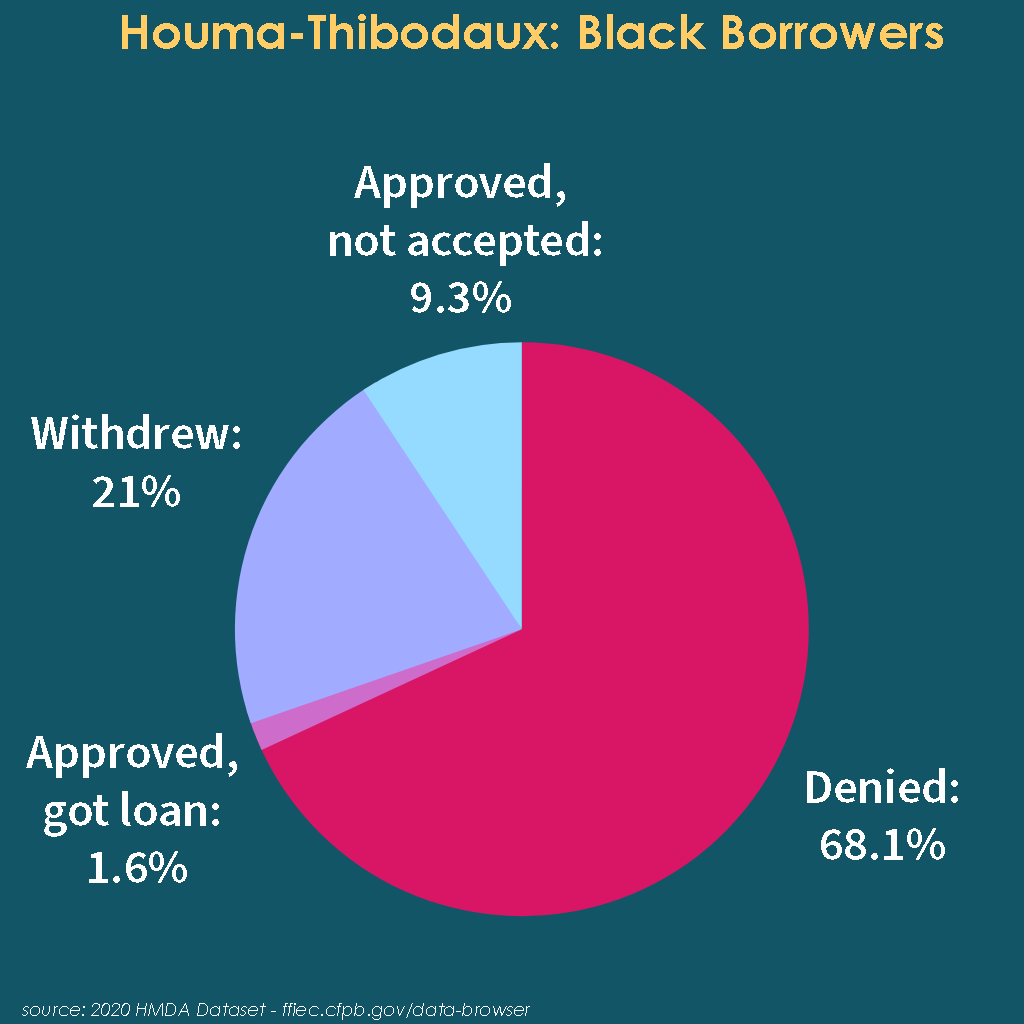

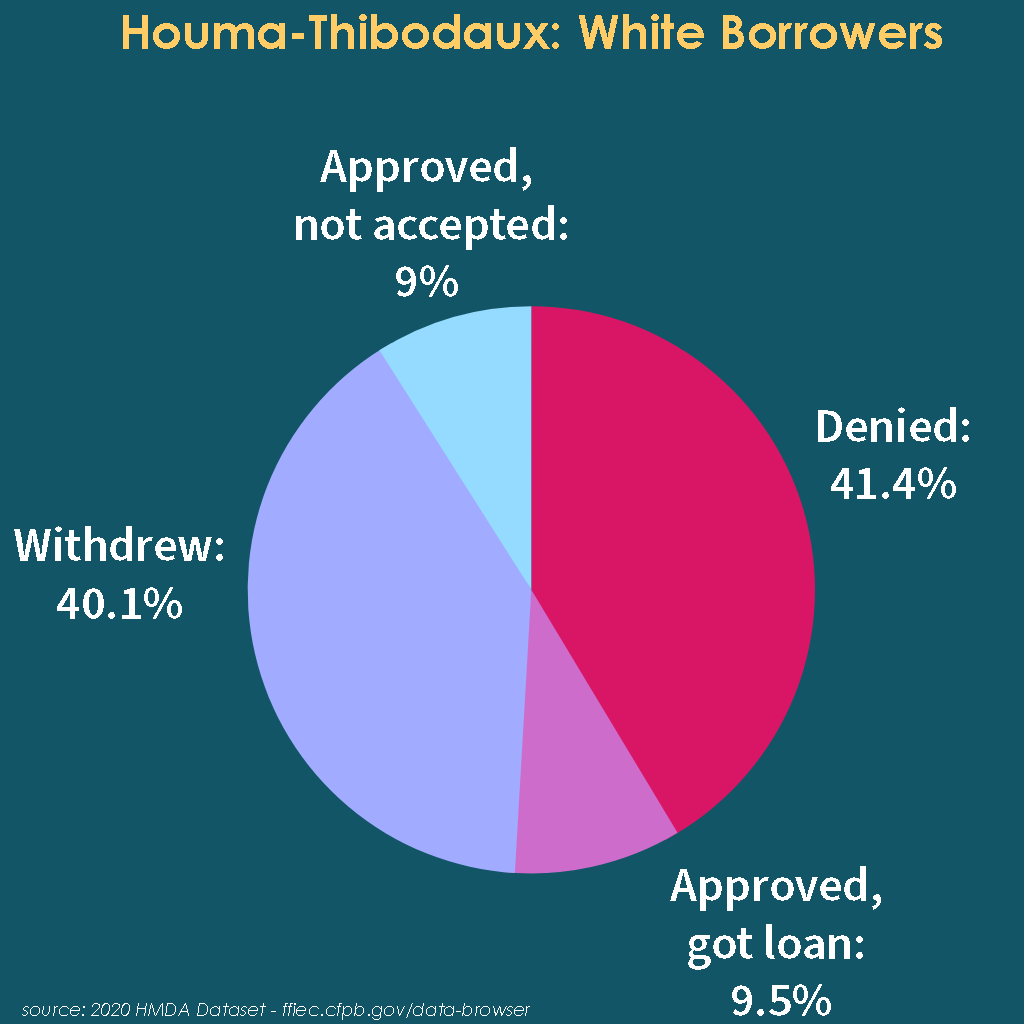

Here is the data for Houma-Thibodaux in 2020:

Houma has the highest percentage of mortgage loan denials for Black would-be homebuyers here, but because a large number of white would-be homebuyers were also denied, the disparity is not as stark as it was in Hammond—nonetheless, only 6 Black households in Houma were able to purchase mortgages in 2020, compared to 191 white households.

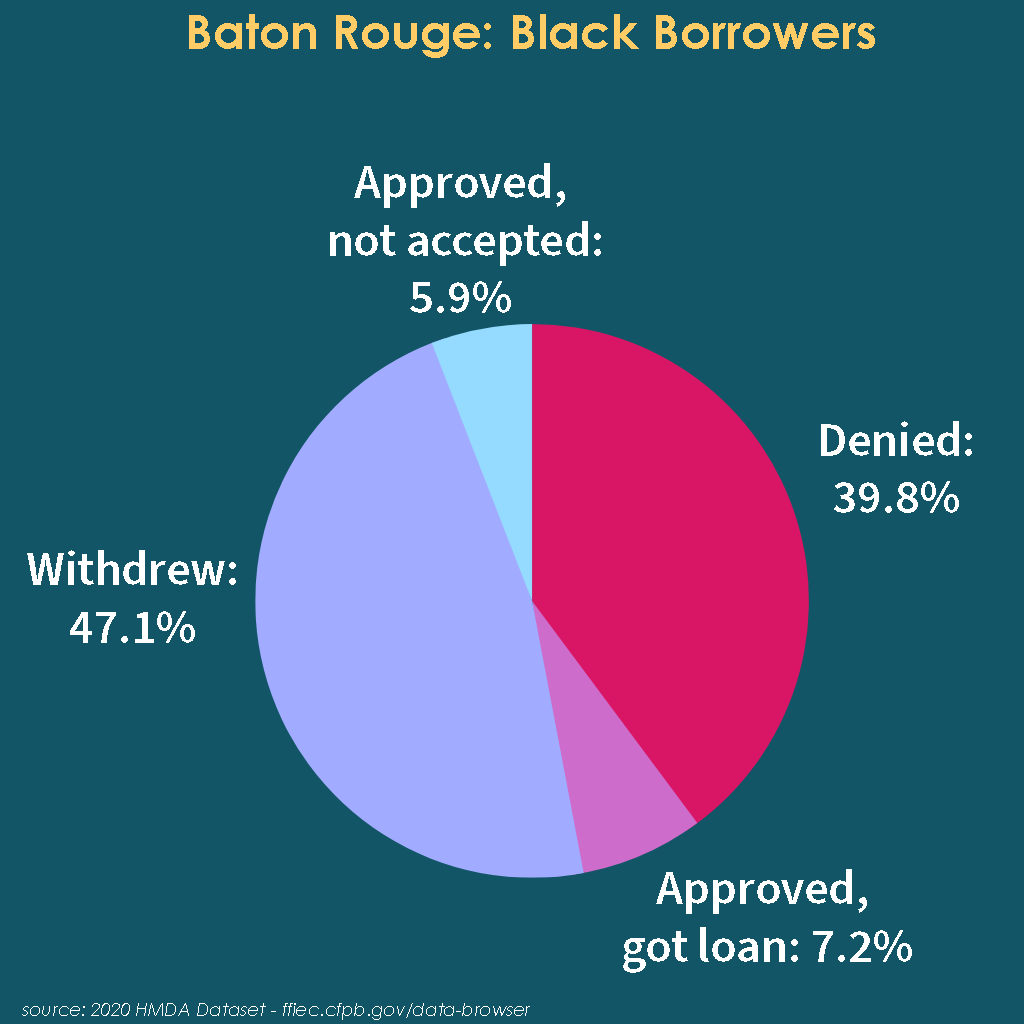

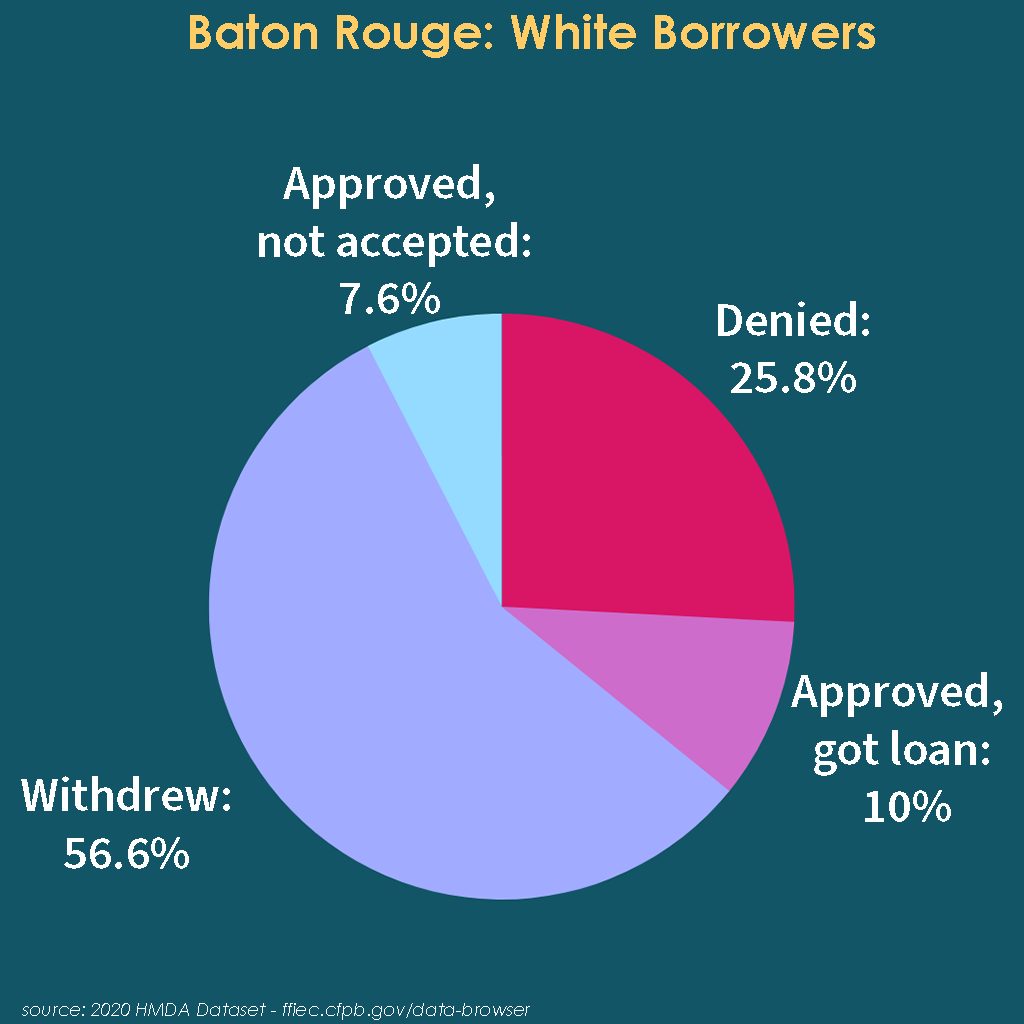

Here is the data for Baton Rouge in 2020:

Baton Rouge had a higher proportion of Black borrowers able to purchase home loans, but still had a significantly higher denial rate between Black and white homebuyers.

Homeownership represents a crucial part of building wealth and ensuring long-term housing for families in Louisiana, and the higher denial rates for Black prospective homebuyers, as well as the higher loan costs, harm both Black Louisianans and the communities where they live. Everyone deserves a safe place to live, raise a family, and build a community. Denying a prospective homebuyer a mortgage, or charging them more based on who they are rather than the financial resources they bring to the table, is a violation of the Fair Housing Act and continues trends of inequality.

If you believe you have been discriminated against when seeking a mortgage, please reach out to us here at LaFHAC—we are here to help.

If you’re facing foreclosure, we’re here for you too — we offer homeownership counseling as part of the Homeownership Protection Program.

Give us a call at (504) 596-2100 or toll free at (877) 445-2100.